There are mounting indications that the Japanese economy is performing exceptionally and entering a virtuous cycle of income gains and increased consumer consumption. In addition, numerous indicators suggest potential upward shifts in Japanese inflation. In Japan, a country battling deflation for thirty years, this is welcome news. This is likely to enhance interest-rate differentials, benefiting the Japanese Yen, especially given the currency’s notable undervaluation. On a Purchasing Power Parity basis, the Yen is undervalued by 40%. The key takeaway for investors is to prioritize the Japanese Yen while concurrently minimizing exposure to Japanese government bonds. A suitable comparison can be drawn to the dynamics of the US Dollar and Treasuries in 2022, where it proved advantageous to invest in the US Dollar and divest from Treasuries. A parallel situation appears to be unfolding in Japan.

The key rationale behind this viewpoint is the substantial evidence suggesting upwardly revised economic surprises in the country. While the Bank of Japan has begun to unwind its Yield Curve Control program, this means that we can expect a more hawkish central bank in the near future. Japan’s Q1 and Q2 2023 real GDP growth figures of 0.9% QoQ and 6.0% QoQ, respectively, reveal a nation that is experiencing high and accelerating growth. Particularly, since the trend or potential growth in the island nation is only approximately 0.5% by the central bank’s own estimates. The consumption activity index has returned to levels seen before the pandemic, despite a generally low propensity to consume in Japan. The country was among the last to lift travel restrictions, leading to cautious spending amid widespread economic uncertainty. As normalcy gradually resumes, accumulated demand is expected to bolster spending in Japan.

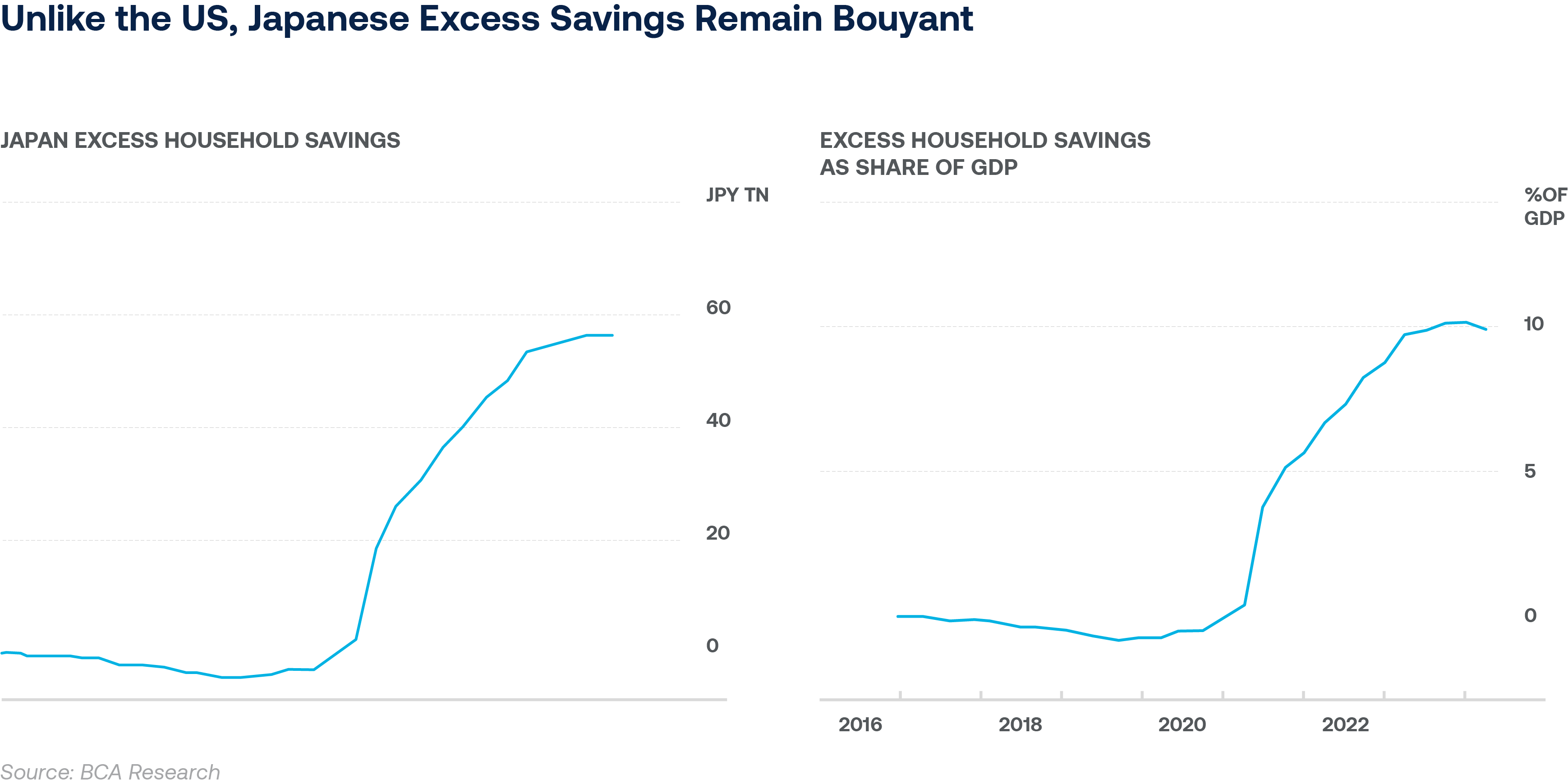

Governmental aid has also allowed households to accumulate significant savings. This graph indicates that excess savings in Japan presently constitute 10% of GDP, maintaining a robust position compared to the sharp decline in the US that we discussed earlier. The Japanese still have a lot of extra money in their pockets. Theoretically, this could enable Japanese consumers to drive economic growth at trend levels solely based on these excess savings for the upcoming five years, not including any income. Additionally, considerations are being made to extend support measures, such as fuel and gas subsidies. Signs of growing consumer confidence are becoming evident across various sectors including employment prospects, income growth, and purchasing intent for durable goods. In our view, only an exogenous shock could derail the Japanese economy at this moment. Some other risks include a deceleration in the pace of foreign machinery orders and machine tool orders. In addition, after a substantial surge over the previous two years, Japanese exports are experiencing a waning despite the currency’s depreciation. However, given the substantial war chest of excess reserves amounting to 10% of GDP, Japanese consumers should be able to weather any storm quite well.

Ahmed Riesgo – Insigneo’s Chief Investment Officer

Mr. Riesgo oversees all the company’s research and investment functions. This includes investment strategy, devising and implementing the firm’s global market views and asset allocation, communicating them to its clients and the public, and managing the firm’s model portfolios. In addition, he is the Chairman of the Insigneo Investment Committee.