Executive Summary: The mega-cap technology stocks that have led the current stock rally will undoubtedly be major beneficiaries of the AI trend. However, the benefits of this new technology will expand well beyond these companies.

During our last quarterly call, we said that dominant players in the AI industry like Microsoft, Alphabet, and Nvidia would be big beneficiaries of the development of this new technology. Boy, are we glad we said that! Since then, these stocks have led the markets higher. Now we have to look beyond mega-cap tech, towards which other companies could also be potential beneficiaries.

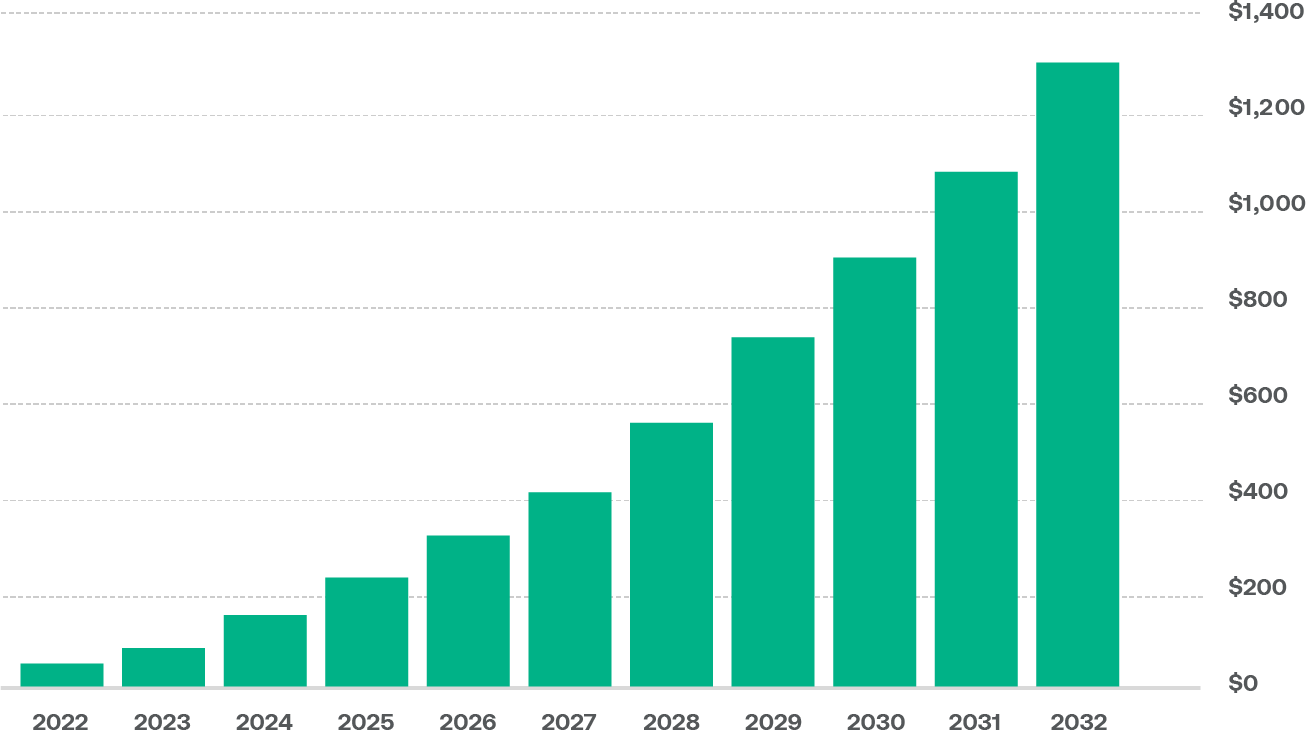

A year ago, artificial intelligence appeared to be a promising technology far in the future. Few people had heard of it, and even fewer had been exposed to it. Fast-froward a year, and artificial intelligence is something very real. Most of us have heard about AI by now. Whether we were introduced to it through the media, a friend, or even personal use of Chat GPT, we can all envision the revolutionary implications that artificial intelligence could have on our everyday lives. Much like with the birth of the internet, a nascent technology such as AI has created a large amount of appetite from investors looking to get exposure to what portends to be a promising bounty. As we can see on the chart on the next page, Bloomberg estimates that Generative AI could lead to approximately $1.3 trillion in revenues by 2032, spread across several technology industries including “hardware, software, services, ads, and gaming centers, growing at an annual compound rate of roughly 42%…” (Mandeep Singh, Nishant Chintala, and Anurag Rana, Bloomberg, 6/5/23). Investors have clearly expressed their views as to which companies would benefit from the AI boom. Stocks such as Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN) and Nvidia (NVDA) have helped propel stock markets higher this year. But so far, the markets appear to be pricing in the idea that only a handful of large-cap technology stocks will be the big beneficiaries from the AI boom. Nvidia alone rose 190% in the first six months of this year, reaching a market cap slightly over $1 trillion. To put things in perspective, the market cap of Bitcoin is approximately $600 billion. Said another way, all the Bitcoin in the market would only purchase 60% of Nvidia. Using the same logic, considering that Microsoft’s market cap is close to $2.5 trillion, the same amount of Bitcoin would only buy about a quarter of Microsoft.

There is little doubt that the dominant players in the AI space such as the companies mentioned above have a lot to gain. Companies engaged in the actual development of the technology will undoubtedly be big beneficiaries of its application. However, the markets are almost behaving like these will be the only companies that will benefit. But what about the second-derivative companies, those beyond mega-cap tech? What about those companies that will be the users of AI or provide services ancillary to the technology?

Artificial intelligence networks can be operated on a large-scale basis, with networks running hyperscale models, or on a smaller scale basis running off cloud-based networks. Nvidia is the dominant player providing data processing equipment for large-scale models powering AI for big end users such as data centers. However, when it comes to cloud-based or ethernet networks, like the ones that will most likely be used to power AI in smaller units such as your smartphone, Nvidia has competition. Companies such as Broadcom (AVGO) and Cisco Systems (CSCO) also offer ethernet solutions that compete with Nvidia, and their stocks trade at less than half of the valuation of their larger rival. As we said before, we have no doubt that first movers like Nvidia will be winners in the AI era. However, let’s remember that this company is predominantly a hardware manufacturer, making the equipment that enables AI. What about the companies that create and use software to power and benefit from artificial intelligence?

During a recent interview, Cathie Wood, manager of the famous ARK family of disruptive technology funds, stipulated that “…for every $1 of AI-related hardware that Nvidia sells, software firms will eventually generate $8 of revenue.” (Cathie Wood, Bloomberg, 6/7/23). As we can see on the next chart, software spending on AI is expected to grow from approximately $5 billion to close to $280 billion by 2032. In fact, AI as a percentage of total software spending is expected to grow from less than 1% currently, to 12% or potentially higher over the next ten years. This increased level of spending on AI is expected to come from a number of industries, such as healthcare, cyber security, software development, robotics, and automation.