While the prevailing sentiment among investors towards China is significantly bearish, mirroring the trends observed during 2015/16, apprehensions surrounding geopolitical conflicts, particularly Taiwan, have notably subsided. Presently, macroeconomic, and regulatory considerations are taking precedence over geopolitical risks, a shift we believe might be somewhat premature. The forthcoming elections in Taiwan could play a pivotal role in determining the trajectory of cross-strait geopolitical tensions. China possesses non-military alternatives that could have severe implications for the markets. Currently, investors should be wary of assuming that countries will overlook national security concerns or weaknesses in favor of economic progress and stability.

China, with its vast geographical core territories and highly-educated and rapidly-urbanizing population is as a formidable global power. Just for comparison, the United States produced six hundred thousand PhDs in STEM fields last year. China produced four million. However, its natural constraints, including deserts, mountains, and distant islands, affect its control and access to the sea. Historical and current tensions with neighboring islands and nations have remained, especially with Taiwan, a potential launchpad for attacks on China’s critical supply lines and ports. The inherent threat that Taiwan poses to China, and vice versa, remains, regardless of the peaceful intentions of their leaders. Contemporary events, such as Russia’s invasion of Ukraine, underline that geopolitical concerns continue to shape nations’ actions, despite advancements in globalization and democracy. Economic prosperity and integration do not necessarily overshadow- ow national security objectives. The persistence of conventional warfare amongst affluent nations demonstrates that security interests often surpass economic ones.

“The forthcoming elections in Taiwan could play a pivotal role in determining the trajectory of cross-strait geopolitical tensions.”

That means that the likelihood of China’s Xi regime engaging in preemptive wars, risking economic and societal stability, remains uncertain. The domestic perception of national capabilities might concurrently underestimate the opposition from other nations. Strategic failures in deterrence have been highlighted by events like the Ukraine war and have implications for China, where the risks of erratic or aggressive national policies are elevated under Xi Jinping’s consolidated rule. Currently, China’s focus is on addressing domestic economic challenges, technological advancement, and preparing for potential conflicts, emphasizing a quest for self-sufficiency, and acknowledging vulnerability to external influences.

The challenges facing China in a potential invasion of Taiwan are considerably greater compared to Russia’s invasion of Ukraine. Russia serves as a cautionary example, emphasizing restraint against engaging in direct conflicts with the West. Despite China’s untested military capabilities, the efficacy of the US’s strategic deterrence, particularly in minor or unconventional actions aimed at undermining Taiwan’s resolve, remains questionable. China can employ a variety of non-military strategies to weaken Taiwan’s economy and will. Meanwhile, the consensus within the US political system on countering China’s influence and supporting Taiwan introduces additional complexities. The outcome of Taiwan’s 2024 Election will significantly influence cross-strait relations, with different parties representing varied prospects for dialogue and strategic détente. A change in political power in Taiwan could alter Beijing’s approach, favoring gradual integration over military conflict, especially given the strategic significance of Taiwan’s prized technological assets – its high-end semiconductor foundries.

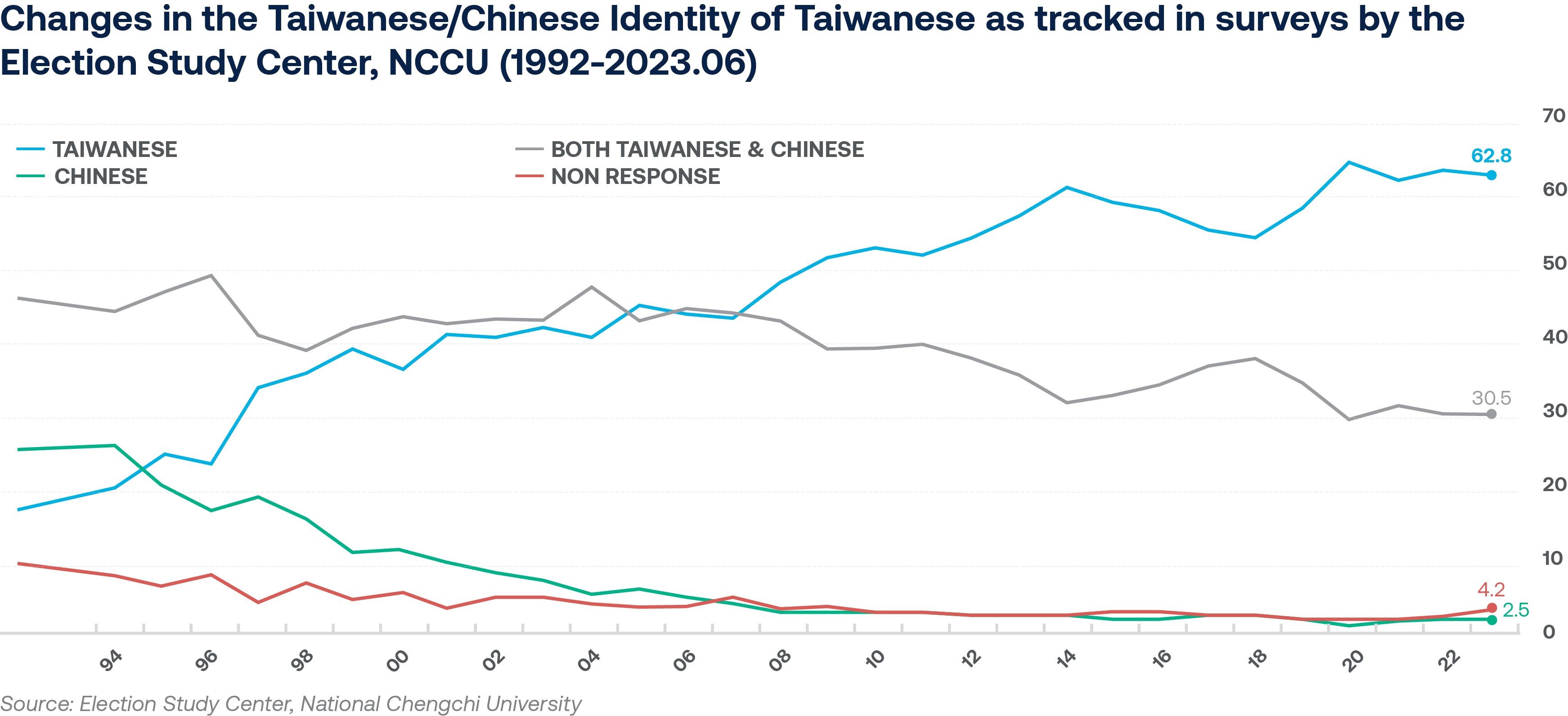

However, even if there is a change in political power in Taiwan, the potential for conflict persists eventually. The distinct Taiwanese identity and their unwillingness to compromise on freedom and security pose challenges to integration. This chart indicates that approximately 63% of the population identifies exclusively as Taiwanese. This shift in identity, coupled with China’s aggressive policies under Xi Jinping, has distanced the democratic Taiwanese further from the Mainland, limiting the concessions that could be made during negotiations.

In anticipation of the upcoming elections, investors should brace for escalating policy uncertainties in both China and Taiwan. The election results will be instrumental in dictating whether tensions escalate or

de-escalate in the short term. While a full-scale invasion by China is not imminent, in our view, a reelection of the Democratic Progressive Party could lead to intensified economic, cyber, and diplomatic pressure on Taiwan. Failing this, Beijing might explore other tactics, including asserting maritime authority, imposing embargoes, or employing hybrid military strategies against Taiwan’s territories. All these actions would increase the geopolitical risk premium on East Asian risk assets.

Ahmed Riesgo – Insigneo’s Chief Investment Officer

Mr. Riesgo oversees all the company’s research and investment functions. This includes investment strategy, devising and implementing the firm’s global market views and asset allocation, communicating them to its clients and the public, and managing the firm’s model portfolios. In addition, he is the Chairman of the Insigneo Investment Committee.