Executive Summary: The mega-cap technology stocks that have led the current stock rally will undoubtedly be major beneficiaries of the AI trend. However, the benefits of this new technology will expand well beyond these companies.

During our last quarterly call, we said that dominant players in the AI industry like Microsoft, Alphabet, and Nvidia would be big beneficiaries of the development of this new technology. Boy, are we glad we said that! Since then, these stocks have led the markets higher. Now we have to look beyond mega-cap tech, towards which other companies could also be potential beneficiaries.

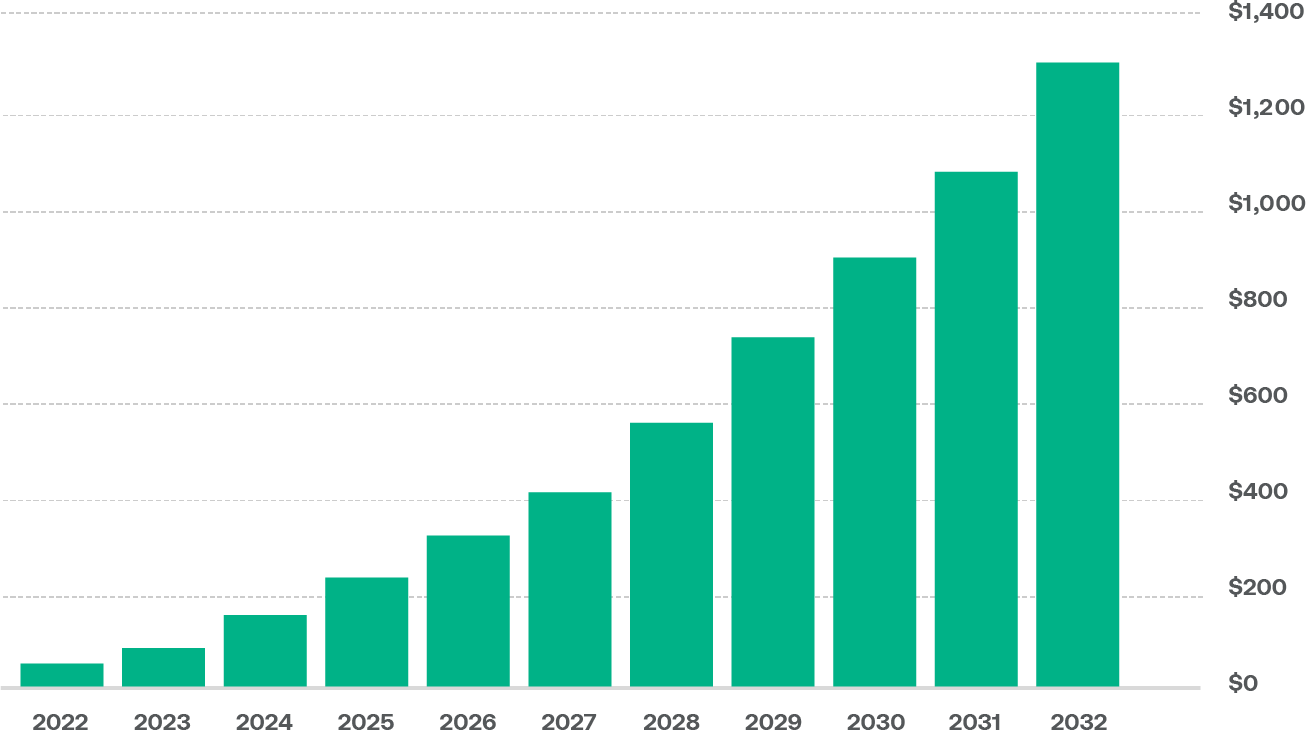

A year ago, artificial intelligence appeared to be a promising technology far in the future. Few people had heard of it, and even fewer had been exposed to it. Fast-froward a year, and artificial intelligence is something very real. Most of us have heard about AI by now. Whether we were introduced to it through the media, a friend, or even personal use of Chat GPT, we can all envision the revolutionary implications that artificial intelligence could have on our everyday lives. Much like with the birth of the internet, a nascent technology such as AI has created a large amount of appetite from investors looking to get exposure to what portends to be a promising bounty. As we can see on the chart on the next page, Bloomberg estimates that Generative AI could lead to approximately $1.3 trillion in revenues by 2032, spread across several technology industries including “hardware, software, services, ads, and gaming centers, growing at an annual compound rate of roughly 42%…” (Mandeep Singh, Nishant Chintala, and Anurag Rana, Bloomberg, 6/5/23). Investors have clearly expressed their views as to which companies would benefit from the AI boom. Stocks such as Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN) and Nvidia (NVDA) have helped propel stock markets higher this year. But so far, the markets appear to be pricing in the idea that only a handful of large-cap technology stocks will be the big beneficiaries from the AI boom. Nvidia alone rose 190% in the first six months of this year, reaching a market cap slightly over $1 trillion. To put things in perspective, the market cap of Bitcoin is approximately $600 billion. Said another way, all the Bitcoin in the market would only purchase 60% of Nvidia. Using the same logic, considering that Microsoft’s market cap is close to $2.5 trillion, the same amount of Bitcoin would only buy about a quarter of Microsoft.

There is little doubt that the dominant players in the AI space such as the companies mentioned above have a lot to gain. Companies engaged in the actual development of the technology will undoubtedly be big beneficiaries of its application. However, the markets are almost behaving like these will be the only companies that will benefit. But what about the second-derivative companies, those beyond mega-cap tech? What about those companies that will be the users of AI or provide services ancillary to the technology?

Artificial intelligence networks can be operated on a large-scale basis, with networks running hyperscale models, or on a smaller scale basis running off cloud-based networks. Nvidia is the dominant player providing data processing equipment for large-scale models powering AI for big end users such as data centers. However, when it comes to cloud-based or ethernet networks, like the ones that will most likely be used to power AI in smaller units such as your smartphone, Nvidia has competition. Companies such as Broadcom (AVGO) and Cisco Systems (CSCO) also offer ethernet solutions that compete with Nvidia, and their stocks trade at less than half of the valuation of their larger rival. As we said before, we have no doubt that first movers like Nvidia will be winners in the AI era. However, let’s remember that this company is predominantly a hardware manufacturer, making the equipment that enables AI. What about the companies that create and use software to power and benefit from artificial intelligence?

During a recent interview, Cathie Wood, manager of the famous ARK family of disruptive technology funds, stipulated that “…for every $1 of AI-related hardware that Nvidia sells, software firms will eventually generate $8 of revenue.” (Cathie Wood, Bloomberg, 6/7/23). As we can see on the next chart, software spending on AI is expected to grow from approximately $5 billion to close to $280 billion by 2032. In fact, AI as a percentage of total software spending is expected to grow from less than 1% currently, to 12% or potentially higher over the next ten years. This increased level of spending on AI is expected to come from a number of industries, such as healthcare, cyber security, software development, robotics, and automation.

Projected Revenues for the Technology Sector from AI (in billions of USD)

Source: Bloomberg Intelligence, IDC, Insigneo, as of 6/1/23

The healthcare industry is one that is set to potentially be revolutionized by the adoption of artificial intelligence. Robots might not replace doctors anytime soon, but they might help make their jobs easier. Overtime, AI is expected to simplify some tasks for clinicians, such as gathering patient information and providing diagnoses and recommendations for simple ailments. This could potentially decrease the need for patients to visit medical clinics and emergency rooms, decreasing the load on the system and shortening appointment wait times. AI could also potentially affect pharmaceutical companies, taking on some of the simpler drug development and manufacturing processes.

Cyber security is another industry that will certainly be affected by artificial intelligence in more than one way. With new technologies come new groups of people trying to exploit them, so it is only a matter of time before hackers try to find ways to use AI for nefarious purposes. We are already hearing stories of AI being used to create fake pictures of events that did not happen or replicate human voices in an attempt to fool a person on the other end of a call. On one hand, artificial intelligence could fill the need for cybersecurity professionals, or at the very least, become an assistant, freeing them to do more specialized tasks. On the other hand, cyber security will be in high demand to protect the valuable networks and software required to operate this new technology. The global market for AI-related cyber security spending could surpass $100 billion over the next decade. Companies like Fortinet (FTNT), Palo Alto Networks (PANW), Okta (OKTA) and ZScaler (ZS) could be potential winners in this space over the long term.

Along the same lines, software development is likely to be simplified, with faster turn-around times, as artificial intelligence is used to read, write, and analyze code. Companies in data aggregation and analytics end markets such as Palantir Technologies (PLTR), Salesforce (CRM), and Snowflake (SNOW) are set to reap meaningful benefits, as they use AI to extract value out of raw data, along side their larger peers in the industry. In fact, symbiotic relationships are likely to flourish between many companies in this segment of the market.

The robotics, defense, and automation industries will also prove to be clear beneficiaries of artificial intelligence. We are already seeing defense companies such as Boeing (BA), Lockheed Martin (LMT), and Northrop Grumman (NOC) begin to test weapon systems based off their own drone platforms that could operate with artificial intelligence. These systems could potentially operate on their own, or at the very least provide a “virtual co-pilot” for the human in charge of the platform. Industrial companies such as Rockwell Automation (ROK), Johnson Controls (JCI), General Electric (GE), and Siemens (SIE GY) are already using artificial intelligence to promote machine learning and create tools and processes to exponentially boost production. The use of goods created by these companies permeates throughout a broad base of industries in the global economy, ranging from the processing of food and drinks to aircraft and auto manufacturing.

Projected Spending on AI Software (in billions of USD)

Source: Bloomberg Intelligence, IDC, Insigneo, as of 6/1/23

“A myriad of factors, including infrastructure and regulation could impact the adoption speed of AI. Most regions in the world currently lack the proper infrastructure to maximize the benefits of this new technology.”

More broadly and perhaps most significantly, the exponential boost to global production capacity over the coming decades is set to have a meaningful impact on productivity growth across the world. Some estimate that the impact of artificial intelligence on global productivity will be akin to China’s joining of the World Trade Organization in 2001 or the internet boom at the beginning of the millennium. These moves lowered labor costs and increased the interdependency of global manufacturing, eventually increasing productivity and driving overall prices lower. However, it took time for these dynamics to have a meaningful impact on global productivity. It is estimated that the internet boom took between 10-15 years to meaningfully increase per capita GDP in most countries around the globe. This is better than the 50+ years that it took the Industrial Revolution to achieve a similar outcome. It will most likely take the AI revolution considerably less time to achieve a meaningful, permanent move in global productivity. Some say that this number could be between 5-10 years, some say it could be less.

A myriad of factors, including infrastructure and regulation could impact the adoption speed of AI. Most regions in the world currently lack the proper infrastructure to maximize the benefits of this new technology. On the regulatory front, we are already seeing regulation take shape in Europe. Earlier this month, government officials in the United States debated the implications of AI on the global arena and how to regulate and mitigate some of its risks.

We have no doubt that artificial intelligence is here to stay and that it will have a meaningful impact on our lives, most likely in a shorter period than the internet boom did. It is important to keep in mind though, that however long it takes, it will probably not be overnight, as some in the market appear to believe. The mega-cap technology stocks that have led the current stock rally will undoubtedly be major beneficiaries of the AI trend. However, the benefits of this new technology will expand well beyond these companies. ■

Mauricio Viaud – Insigneo’s Senior Investment Strategist and Portfolio Manager.